How to do Futures Trading on Pionex

What are Perpetual Futures Contracts?

A futures contract entails an agreement between two parties to buy or sell an asset at a predetermined price and date in the future. These assets span commodities like gold or oil to financial instruments like cryptocurrencies or stocks. This contractual arrangement is a robust tool for mitigating potential losses and securing profits.

Perpetual futures contracts represent a derivative enabling traders to speculate on the future price of an underlying asset without actual ownership. Unlike regular futures contracts with fixed expiration dates, perpetual futures contracts do not expire. Consequently, traders can maintain their positions indefinitely, capitalizing on long-term market trends and potentially realizing substantial profits. Additionally, perpetual futures contracts often incorporate distinctive features like funding rates, which contribute to maintaining their price alignment with the underlying asset.

Notably, perpetual futures lack settlement periods, allowing traders to hold positions as long as they have sufficient margin. For instance, if one purchases BTC/USDT perpetual at $30,000, there is no contractual expiry time binding the trade. Closure of the trade to secure profit or manage losses can be executed at the trader’s discretion. While trading perpetual futures is restricted in the U.S., the global market for perpetual futures is substantial, accounting for nearly 75% of cryptocurrency trading worldwide last year.

In conclusion, perpetual futures contracts are valuable for traders seeking exposure to cryptocurrency markets. However, it is crucial to recognize that they entail significant risks and should be approached with caution.

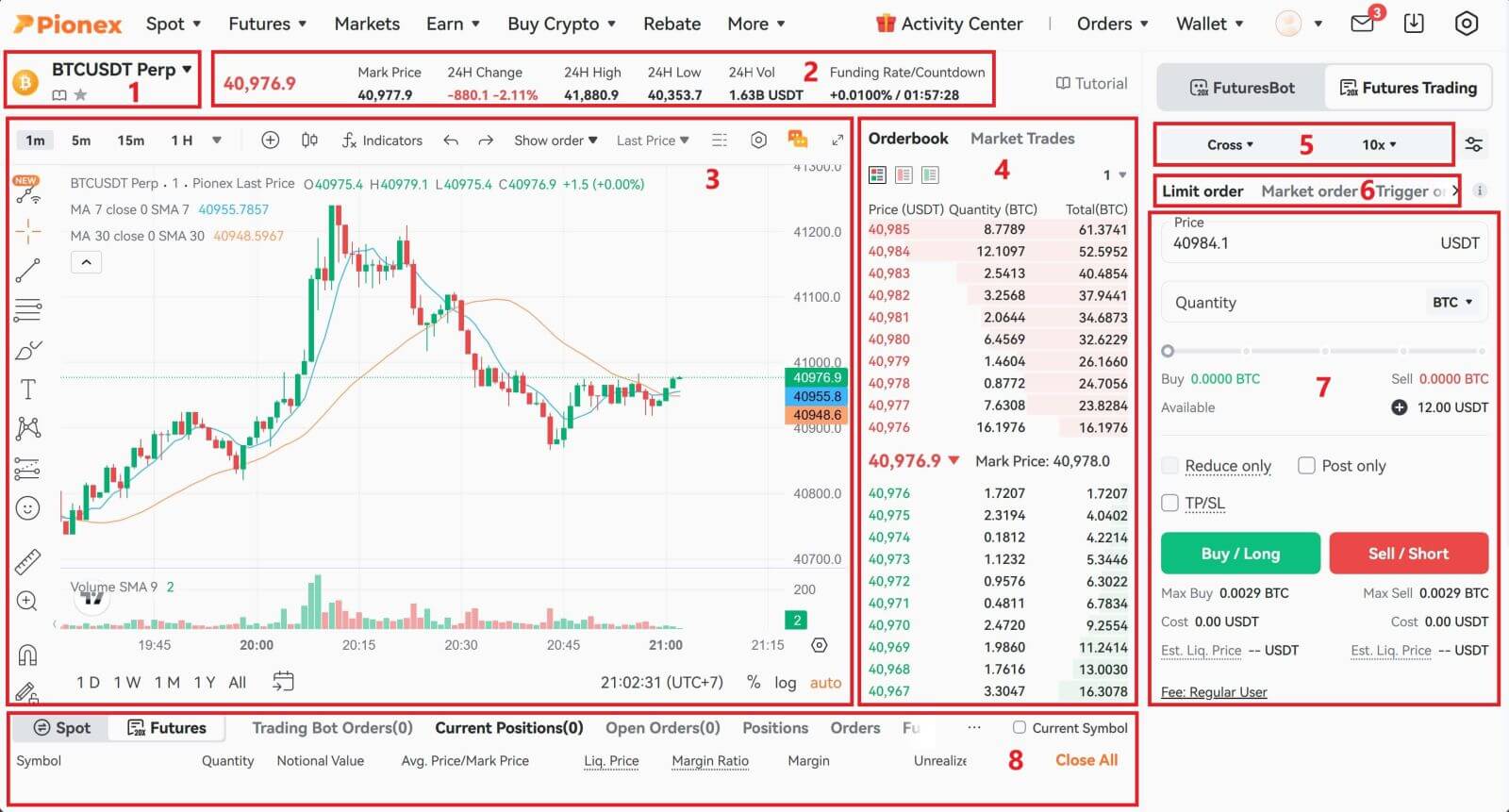

- Trading Pairs: Displays the present contracts underlying cryptocurrencies. Users can click here to switch to alternative varieties.

- Trading Data and Funding Rate: Present pricing, highest and lowest figures, rate of increase/decrease, and trading volume data for the last 24 hours. Also, showcase the current and upcoming funding rates.

- TradingView Price Trend: K-line chart illustrating the price changes of the current trading pair. On the left side, users can click to choose drawing tools and indicators for technical analysis.

- Orderbook and Transaction Data: Present the current order book and real-time transaction order information.

- Position and Leverage: Toggle between position modes and adjust the leverage multiplier.

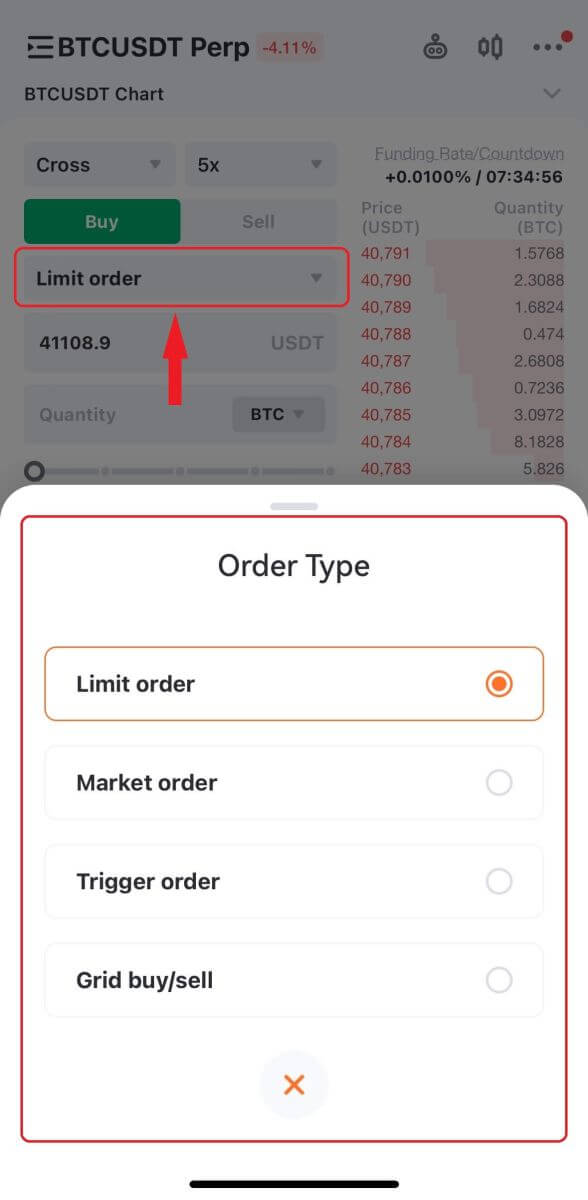

- Order type: Users can select from limit orders, market orders, trigger orders and grid buy/sell options.

- Operation panel: Allow users to make fund transfers and place orders.

- Position and Order information: Current position, open orders, historical orders and transaction history.

How to Trade Perpetual Futures on Pionex (Web)

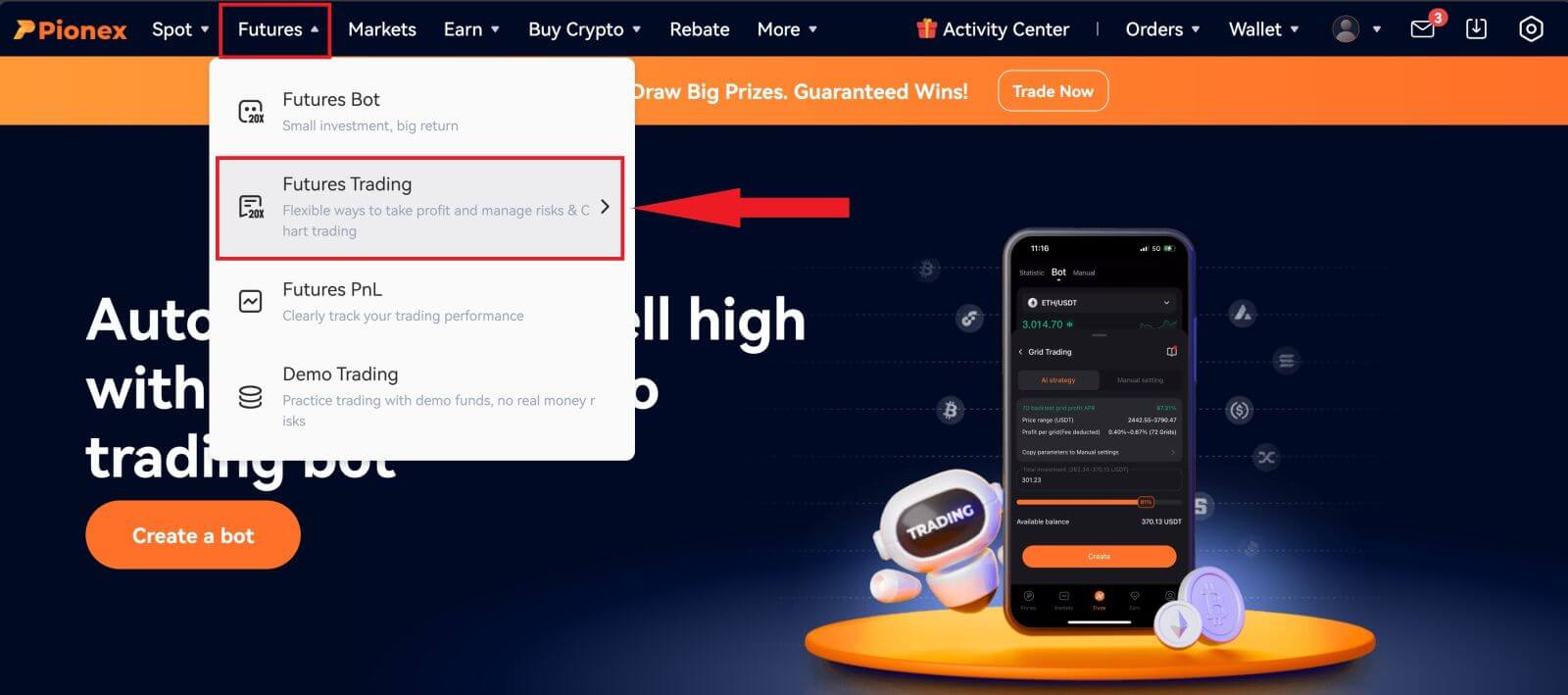

1. Log in to Pionex website, navigate to the "Futures" section by clicking the tab at the top of the page and then click "Futures Trading".

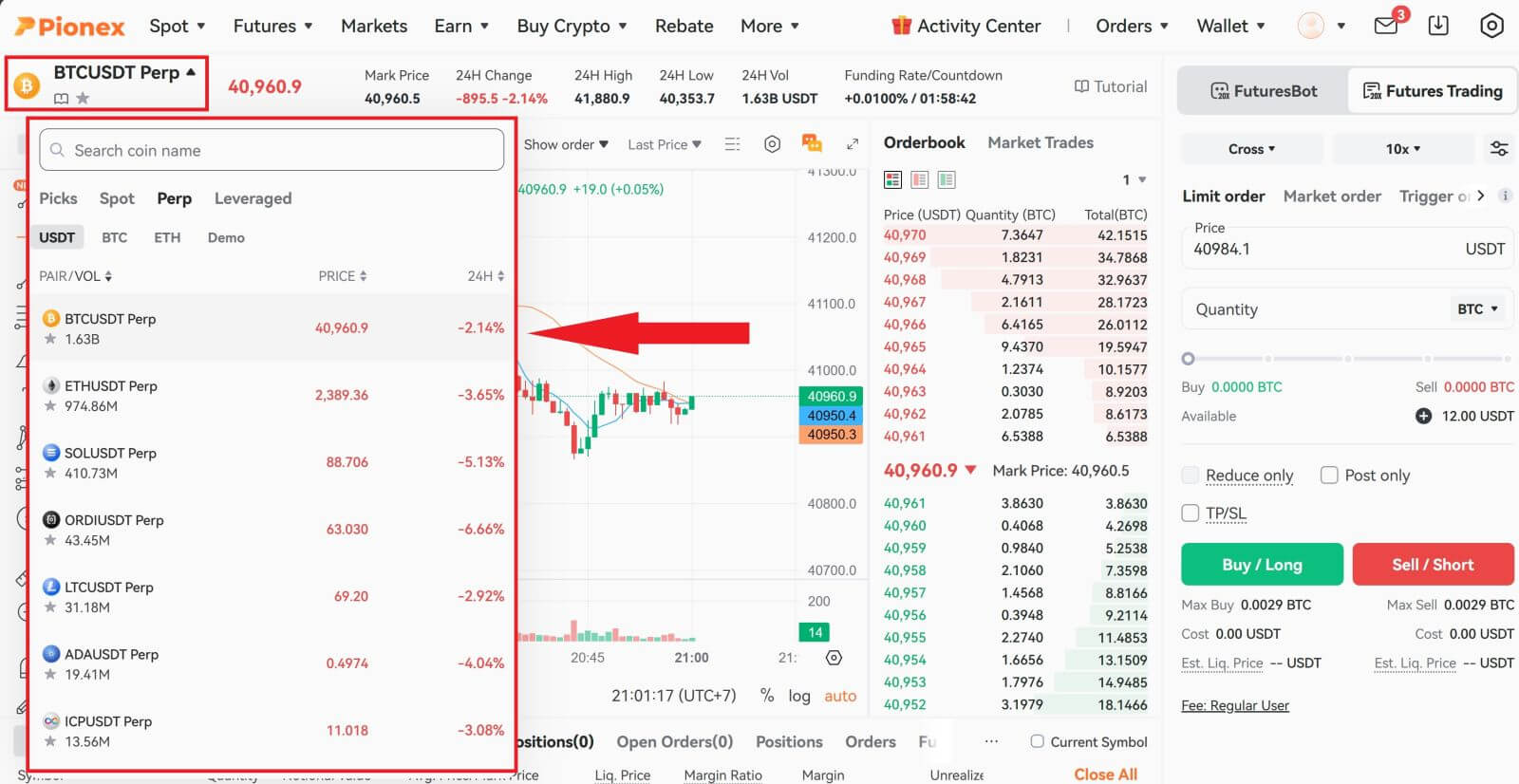

2. On the left-hand side, select BTCUSDT Perp from the list of Futures.

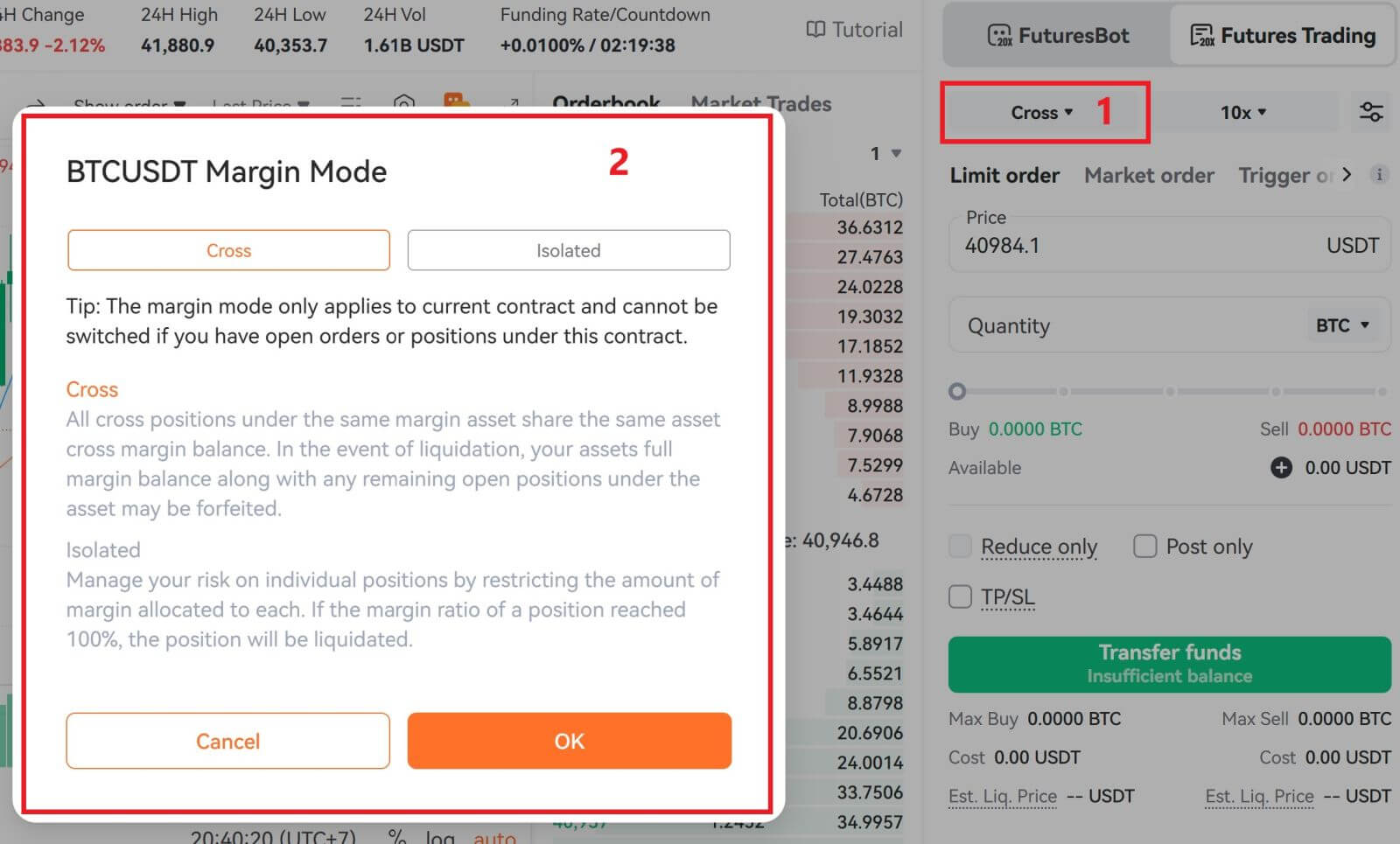

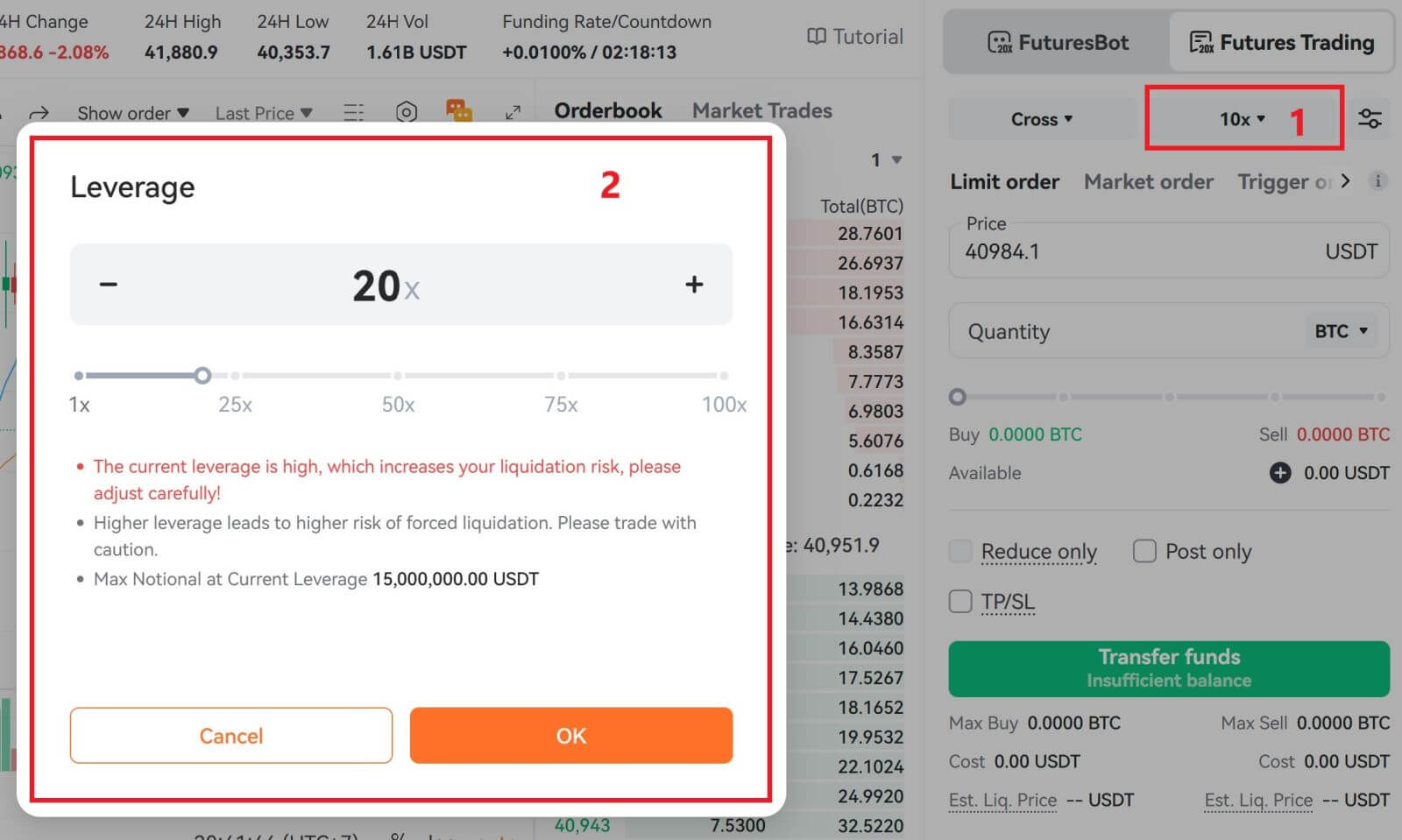

3. Opt for "Position by Position" on the right to change position modes. Adjust the leverage multiplier by clicking on the number. Different products support different leverage multiples—refer to the specific product details for more information.

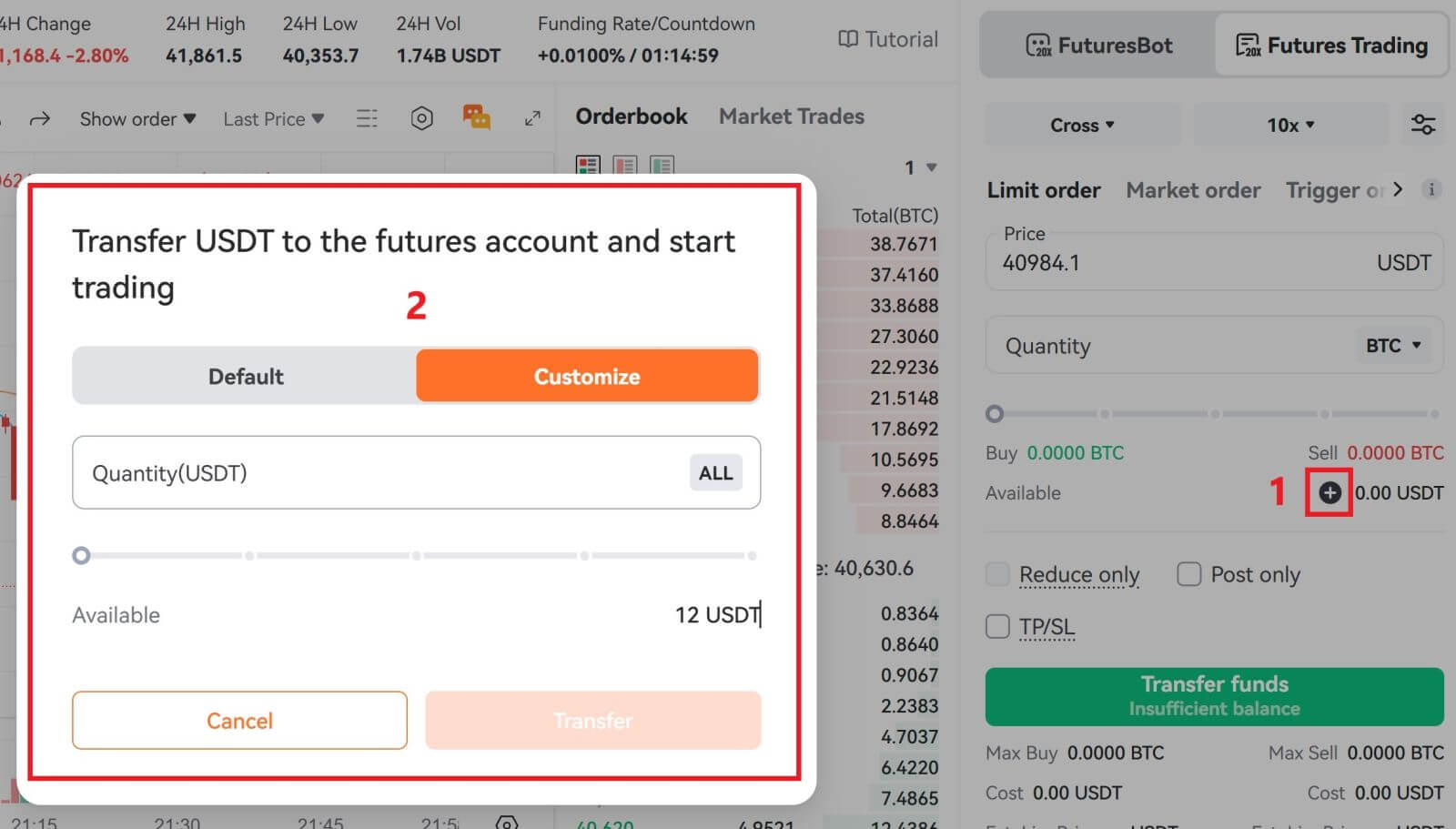

4. Click the small plus button on the right to open the transfer menu. Enter the desired amount for transferring funds from the Spot account to the Futures account and then click Transfer.

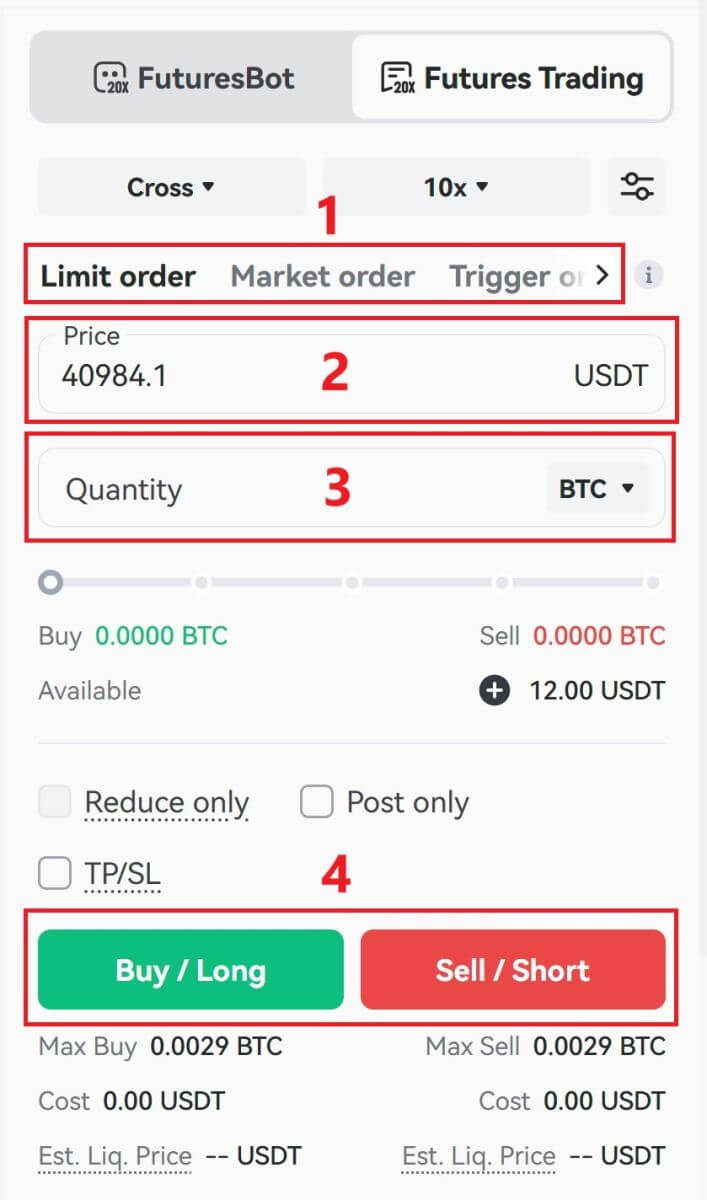

5. To open a position, users can choose between four options: Limit Order, Market Order, Trigger Order and Grid buy/sell. Enter the order price and quantity then click Buy / Sell.

- Limit Order: Users determine the buying or selling price independently. The order will only execute when the market price aligns with the set price. If the market price does not reach the set price, the limit order will persist in the order book, awaiting transaction.

- Market Order: A market order involves executing a transaction without specifying a buying or selling price. The system completes the transaction based on the latest market price at the time of placing the order, requiring the user only to input the desired order amount.

- Trigger Order: Users need to set a trigger price, order price, and amount. The order will be executed as a limit order with the predetermined price and amount only when the latest market price reaches the trigger price.

- Grid buy/sell: It is designed to facilitate the swift opening of a position through the execution of multiple orders within a grid with just one click.

6. Upon placing your order, locate it under "Open Orders" at the bottom of the page. Orders can be canceled before they are filled. Once filled, you can find them under "Position".

7. To exit your position, select "Close".

How to Trade Perpetual Futures on Pionex (App)

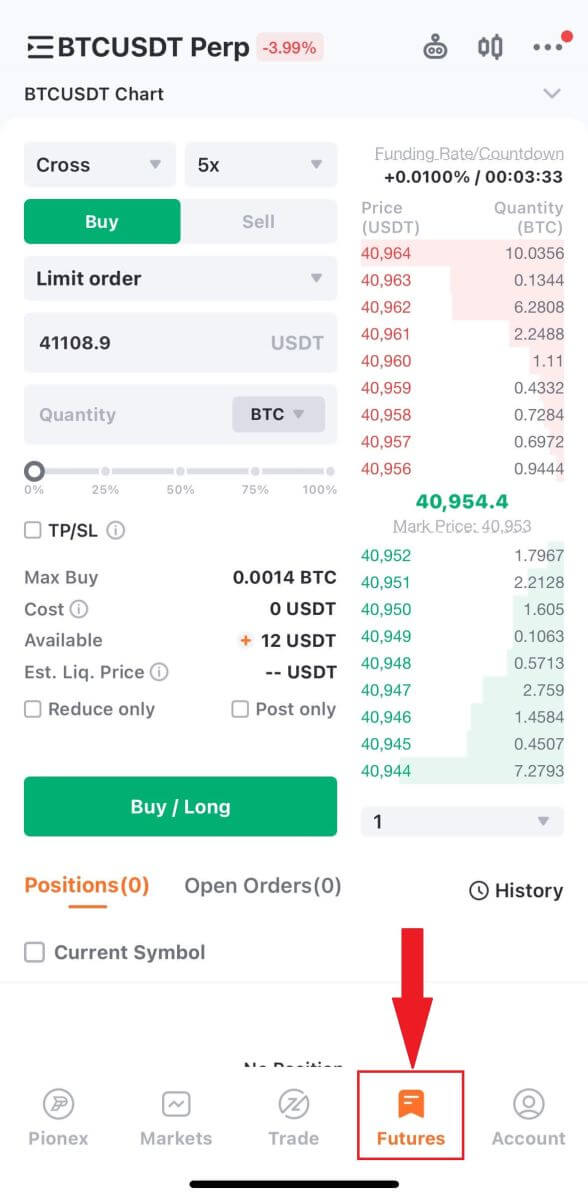

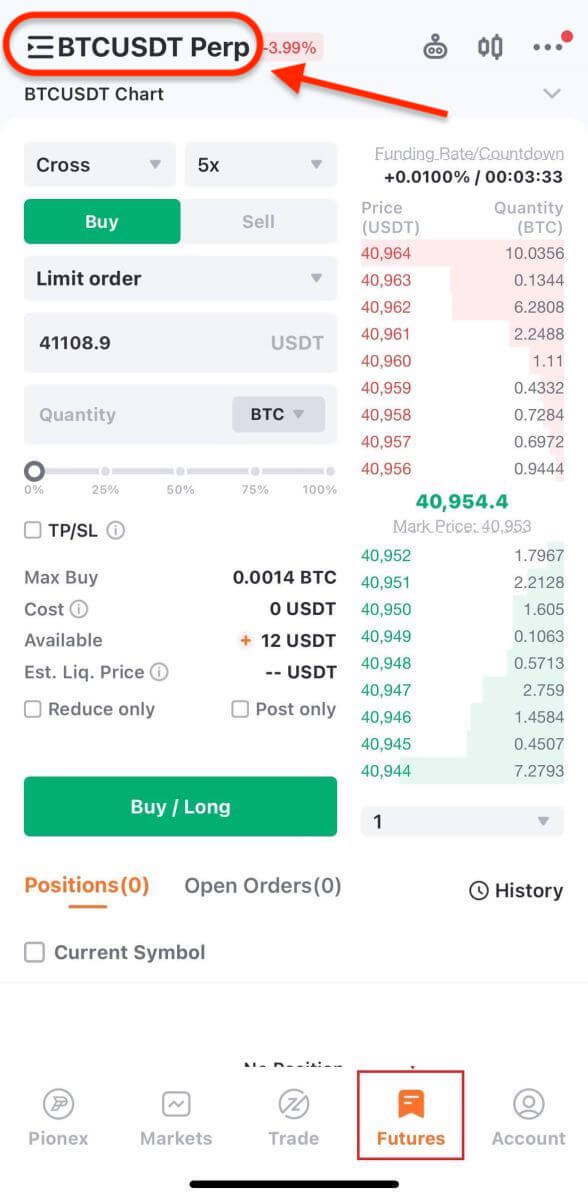

1. Log in to your Pionex account through the mobile application and navigate to the "Futures" section positioned at the bottom of the screen.

2. Tap on BTCUSDT Perp located at the top left to switch between various trading pairs. Use the search bar or choose directly from the listed options to find the desired futures for trading.

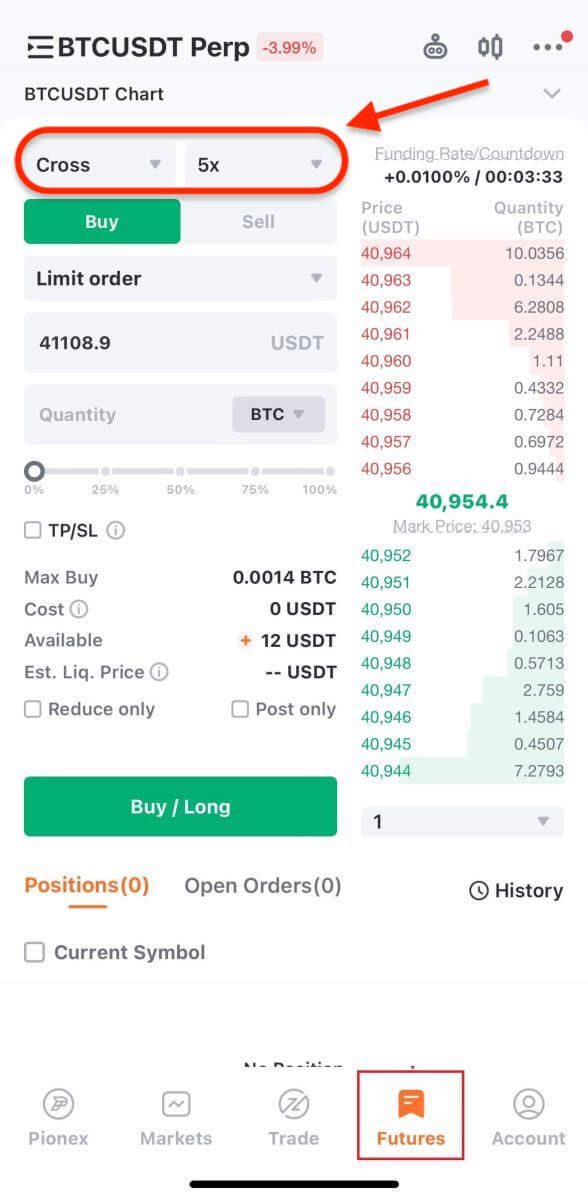

3. Select the margin mode and tailor the leverage settings to your preference.

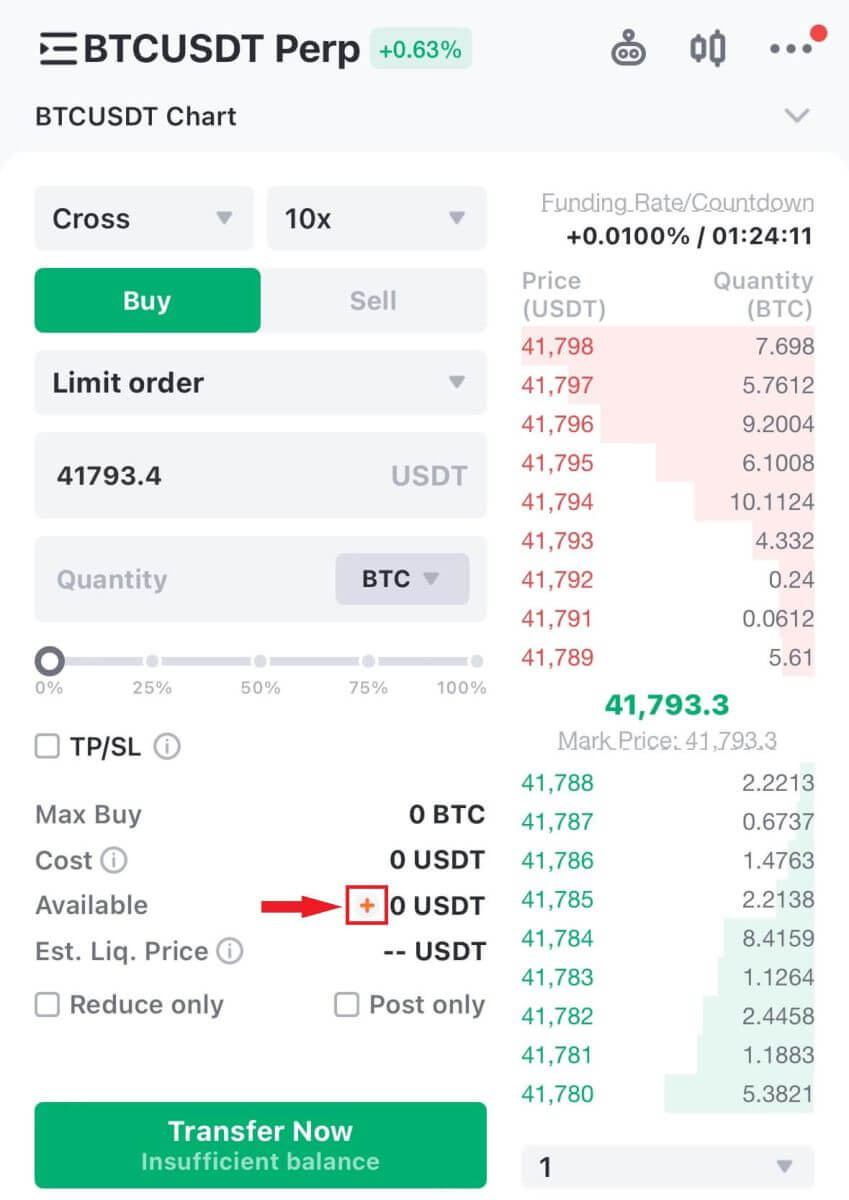

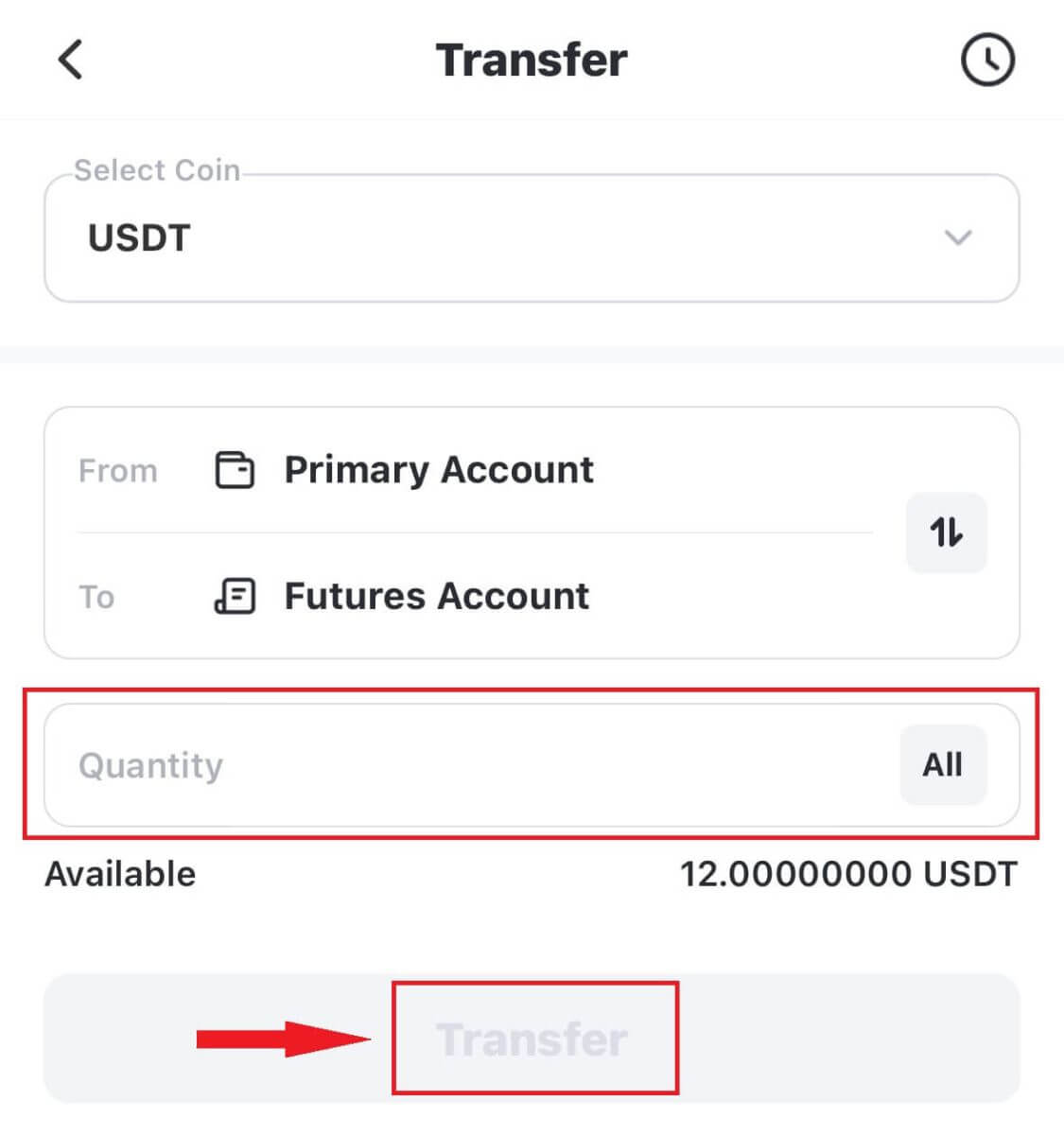

4. Click the small plus button on the right to open the transfer menu. Enter the quantity for transferring funds from the Spot account to the Futures account and then click Transfer.

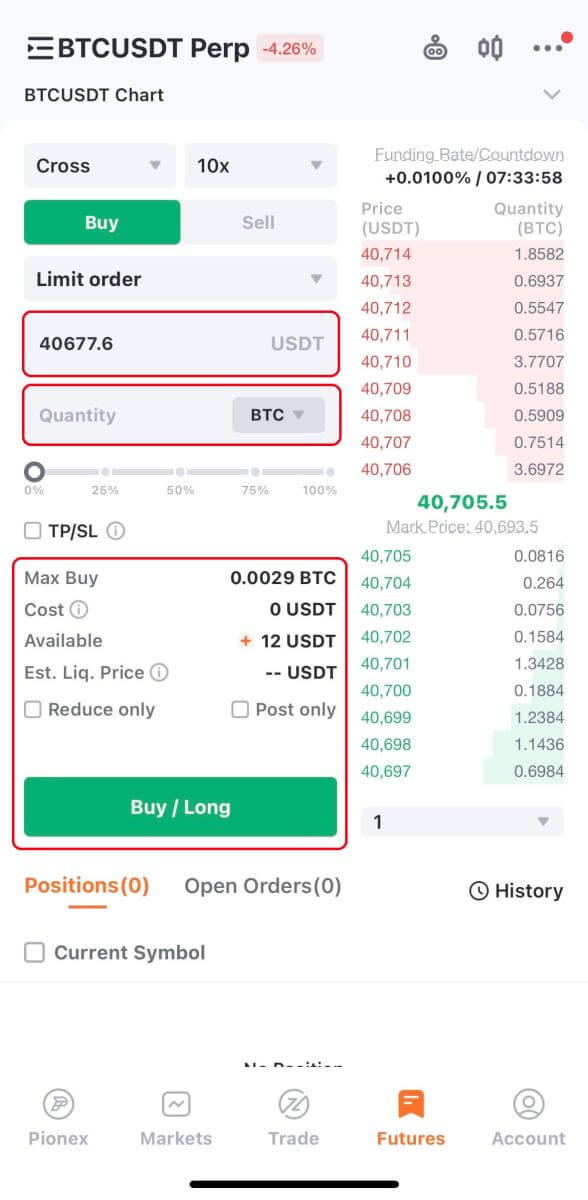

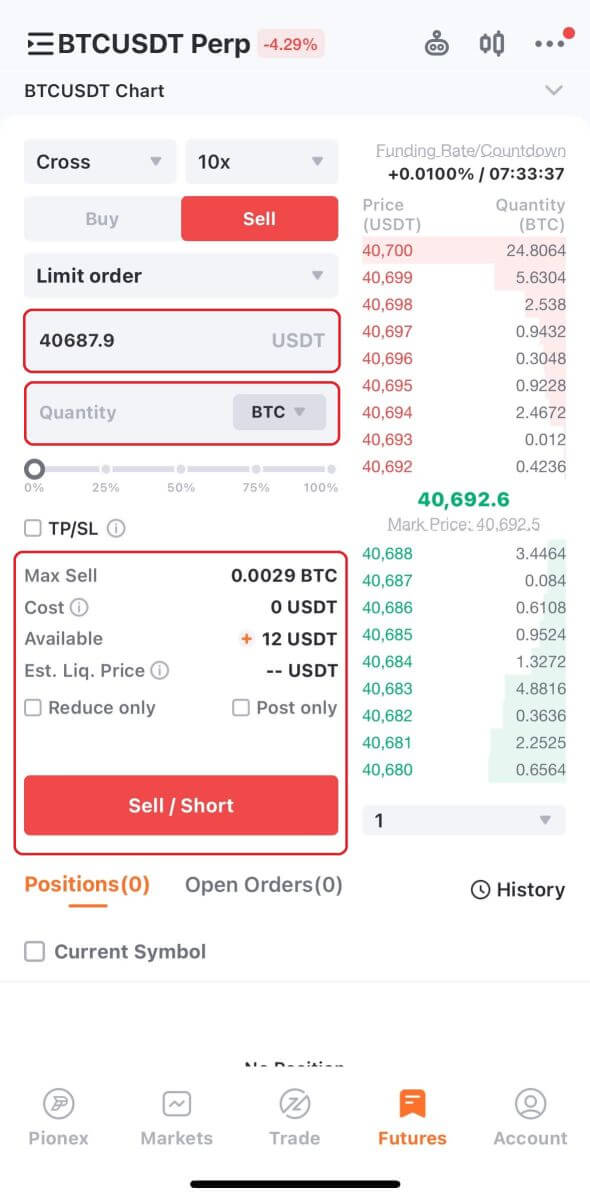

5. On the left side of the screen, input your order details. For a limit order, provide the price and amount; for a market order, enter only the amount. Tap "Buy" to initiate a long position or "Sell" for a short position.

6. After placing an order, if it is not filled immediately, you will find it in the "Open Orders" section. Users have the option to tap "Cancel" to revoke pending orders. Fulfilled orders will be listed under "Positions".

Frequently Asked Questions (FAQ)

What are the main features of perpetual futures contract trading?

Although perpetual futures contracts are a recent addition to the trading landscape, they have swiftly become popular among traders seeking a flexible and versatile approach to speculative trading. Whether you are an experienced trader or a novice, delving into the intricacies of perpetual futures contracts is undoubtedly worthwhile.Initial margin

- Initial margin is the minimum fund amount necessary to deposit into a trading account for initiating a new position. This margin serves the dual purpose of ensuring traders can fulfill their obligations in the event of adverse market movements and acts as a safeguard against volatile price fluctuations. Though initial margin requirements differ among exchanges, they usually constitute a fraction of the total trade value. Prudent management of initial margin levels is essential to steer clear of liquidation or margin calls. Additionally, staying informed about margin requirements and regulations across various platforms is advisable to enhance and optimize your trading experience.

- Maintenance margin represents the minimum funds an investor must uphold in their account to retain an open position. Essentially, it is the required amount to sustain a position in a perpetual futures contract. This measure is implemented to safeguard both the exchange and the investor from potential losses. Failure to meet the maintenance margin could prompt the crypto derivatives exchange to close the position or undertake alternative actions to guarantee the remaining funds adequately cover the incurred losses.

- Liquidation involves the closure of a trader’s position when their available margin drops below a specific threshold. The goal of liquidation is to manage risk and prevent traders from incurring losses beyond their capacity. Vigilantly monitoring margin levels is crucial for traders to sidestep liquidation. Conversely, for other traders, liquidation can serve as an opportunity to leverage a price decline by entering the market at a lower price.

- The funding rate serves as a mechanism to align the price of perpetual futures contracts with the underlying price of Bitcoin. A positive funding rate implies that long positions compensate for shorts, while a negative rate indicates shorts compensate for longs. Recognizing and comprehending funding rates is pivotal, as they can significantly influence an investor’s profit and loss. Therefore, it is essential to monitor funding rates diligently when engaging in perpetual futures trading, including perpetual bitcoin futures and perpetual ether futures.

- The mark price represents the fair value of an asset, calculated by considering bid and ask prices across various trading platforms. Its role is to counteract market manipulation, ensuring the futures contract’s price aligns with the underlying asset. Consequently, if the cryptocurrency’s market price fluctuates, the mark price of the futures contracts adjusts accordingly, providing a foundation for more accurate and informed trading decisions.

- PnL, an abbreviation for "profit and loss," serves as a metric for gauging potential gains or losses in the realm of buying and selling perpetual futures contracts, such as perpetual bitcoin contracts and perpetual ether contracts. In essence, PnL is computed by determining the disparity between the entry price and the exit price of a trade, considering any fees or funding costs linked to the contract.

- The insurance fund within perpetual futures, including contracts like perpetual BTC and perpetual ETH, functions as a protective reserve. Its primary purpose is to shield traders from potential losses stemming from abrupt market fluctuations. Essentially, in the event of an unforeseen and sudden market downturn, the insurance fund serves as a buffer, stepping in to cover losses and preventing traders from having to liquidate their positions. This fund acts as a crucial safety net in the face of a volatile and unpredictable market, highlighting one of the adaptive measures in the continuous evolution of perpetual futures trading to meet user needs.

- Auto-deleveraging functions as a risk management mechanism that ensures the closure of trading positions when margin funds are insufficient. Put simply, if a trader’s position moves unfavorably, and their margin balance dips below the required maintenance level, the crypto derivatives exchange will automatically deleverage their position. While this may initially seem disadvantageous, it serves as a preventive measure to shield traders from exceeding affordable losses. It is imperative for individuals engaged in perpetual futures trading, including contracts like perpetual bitcoin and perpetual ether, to comprehend how auto-deleveraging can impact their positions and leverage it as an opportunity to evaluate and enhance their risk management strategies.

How do perpetual futures contracts work?

Let’s delve into a hypothetical scenario to unravel the workings of perpetual futures. Imagine a trader holding BTC. Upon purchasing a contract, they anticipate an increase in line with the BTC/USDT price or a contrary movement upon selling the contract. Given that each contract holds a value of $1, acquiring one at a price of $50.50 entails a payment of $1 in BTC. Conversely, selling the contract results in obtaining $1 worth of BTC at the selling price, applicable even if the sale precedes acquisition.

It’s crucial to recognize that the trader is trading contracts, not BTC or dollars. So, why engage in crypto perpetual futures trading, and how can one be certain that the contract’s price will mirror the BTC/USDT price?

The answer lies in a funding mechanism. Long position holders receive the funding rate, compensated by short position holders when the contract price lags behind the BTC price. This provides an incentive for purchasing contracts, prompting an increase in the contract price, and aligning it with the BTC/USDT price. Conversely, short position holders can acquire contracts to close their positions, potentially elevating the contract price to match the BTC price.

In contrast, when the contract price surpasses the BTC price, long position holders pay short position holders. This encourages sellers to offload contracts, narrowing the price gap and realigning it with the BTC price. The disparity between the contract price and the BTC price determines the funding rate one receives or pays.

What are the differences between perpetual futures contracts and traditional futures contracts?

Perpetual futures contracts and traditional futures contracts represent distinct variations in futures trading, each offering unique advantages and risks to traders and investors. Unlike traditional counterparts, perpetual futures contracts lack a predefined expiration date, affording traders the flexibility to maintain positions indefinitely. Additionally, perpetual contracts provide enhanced flexibility and liquidity concerning margin requirements and funding costs. Furthermore, these contracts employ innovative mechanisms such as funding rates to ensure close alignment with the underlying asset’s spot price.

Nevertheless, perpetual contracts introduce unique risks, including funding costs that may fluctuate as frequently as every 8 hours. In contrast, traditional futures contracts adhere to fixed expiration dates and may entail higher margin requirements, potentially limiting a trader’s flexibility and introducing uncertainty. The choice between these contracts ultimately hinges on a trader’s risk tolerance, trading objectives, and prevailing market conditions.

What are the differences between perpetual futures contracts and margin trading?

Perpetual futures contracts and margin trading both offer avenues for traders to amplify their exposure to cryptocurrency markets, yet they diverge in significant ways.

- Timeframe: Perpetual futures contracts lack an expiration date, providing a continuous trading option. In contrast, margin trading usually occurs within a shorter timeframe, involving traders borrowing funds to open positions for specific durations.

- Settlement: Perpetual futures contracts are settled using the index price of the underlying cryptocurrency, whereas margin trading settles based on the cryptocurrency’s price at the moment the position is closed.

- Leverage: While both perpetual futures contracts and margin trading enable traders to leverage their market exposure, perpetual futures contracts generally provide higher levels of leverage compared to margin trading. This heightened leverage amplifies both potential profits and potential losses.

- Fees: Perpetual futures contracts commonly incur a funding fee for traders maintaining open positions over an extended period. In contrast, margin trading typically involves paying interest on the borrowed funds.

- Collateral: Perpetual futures contracts mandate traders to deposit a specified amount of cryptocurrency as collateral for opening a position, whereas margin trading necessitates the deposit of funds as collateral.