How to Trade Crypto on Pionex

Cryptocurrency trading has gained immense popularity in recent years, offering individuals an opportunity to profit from the dynamic and rapidly evolving digital asset market. However, trading cryptocurrencies can be both exciting and challenging, especially for beginners. This guide is designed to help newcomers navigate the world of crypto trading with confidence and prudence. Here, we will provide you with essential tips and strategies to get started on your crypto trading journey.

How to Trade Spot on Pionex (Web)

A spot trade involves a straightforward transaction between a buyer and a seller, executed at the prevailing market rate, commonly referred to as the spot price. This transaction occurs instantly upon the fulfillment of the order.

Users have the option to prearrange spot trades, activating them when a particular, more favorable spot price is achieved, a scenario known as a limit order. On Pionex, you can execute spot trades conveniently using our trading page interface.

1. Visit our Pionex website, and click on [Sign in] at the top right of the page to log into your Pionex account.

2. Navigate directly to the spot trading page by clicking on "Spot Trading" from the home page.

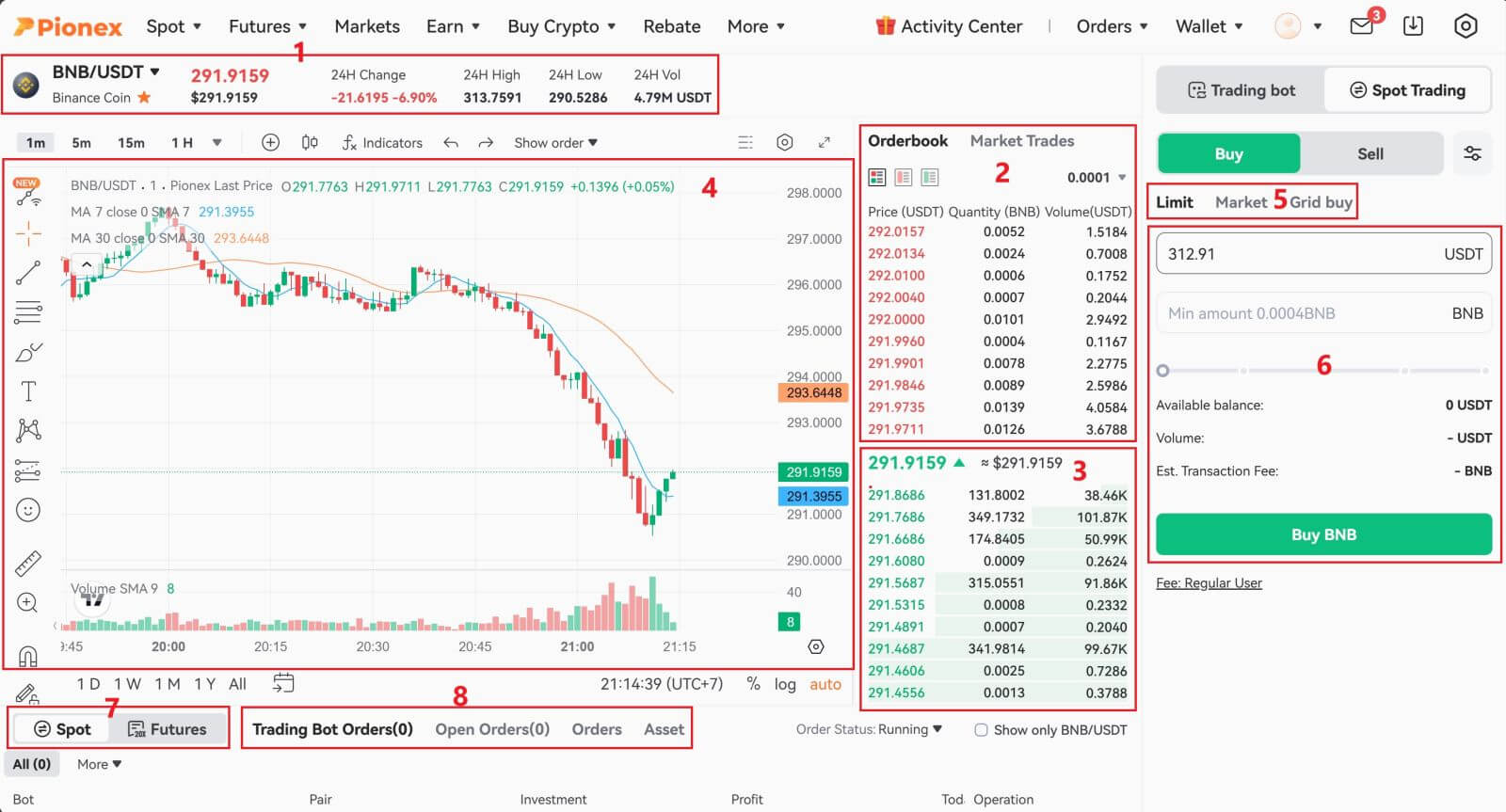

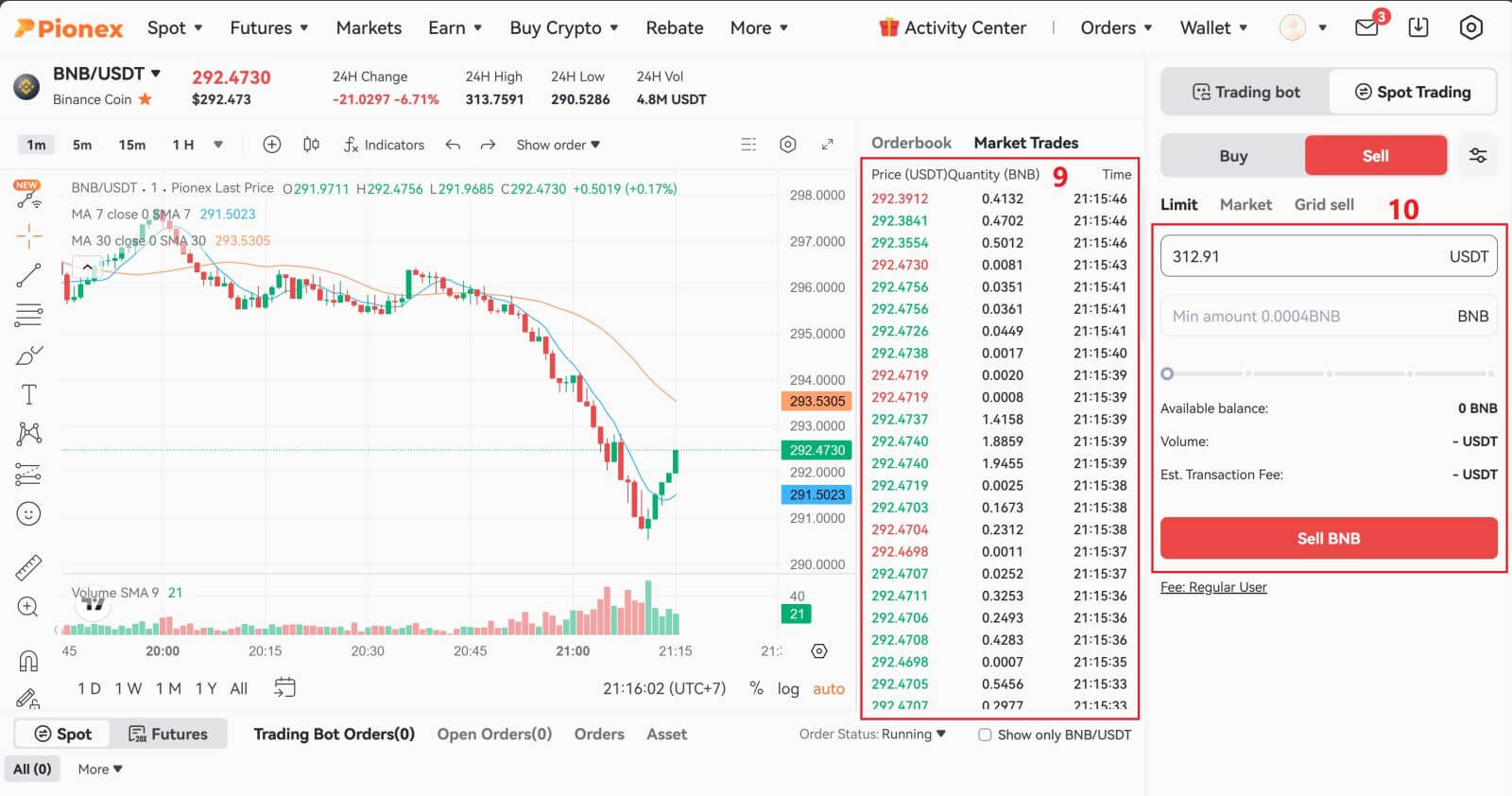

3. You are now on the trading page interface.

- Trading volume of trading pair in 24 hours

- Sell order book

- Buy order book

- Candlestick Chart and Market Depth

- Type of order: Limit/Market/Grid

- Buy Cryptocurrency

- Trading Type: Spot/ Futures Margin

- Trading bot orders and Open orders

- Market’s latest completed transaction

- Sell Cryptocurrency

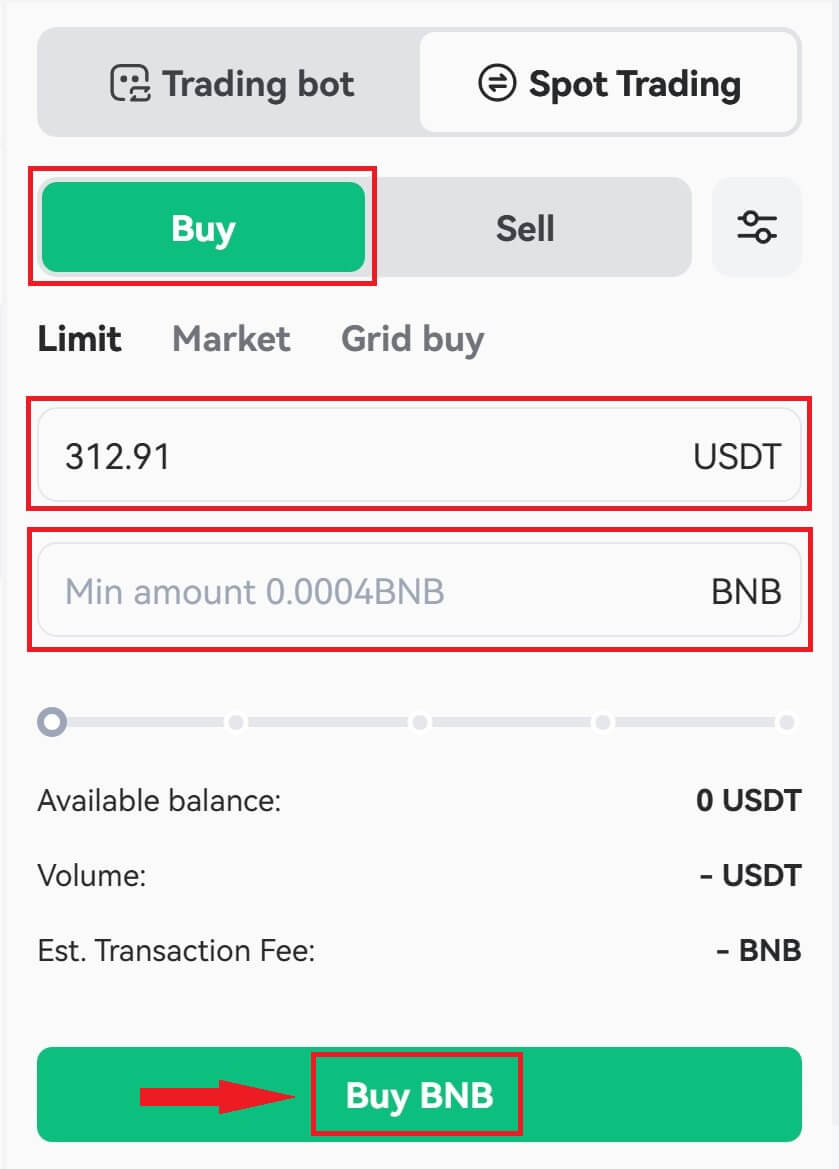

4. Consider the following steps for purchasing BNB on Pionex: Navigate to the top left corner of the Pionex home page and select the [Trade] option.

Choose BNB/USDT as your trading pair and input the desired price and amount for your order. Finally, click on [Buy BNB] to execute the transaction.

You can follow the same steps to sell BNB.

- The default order type is a limit order. To execute an order promptly, traders have the option to switch to a [Market] Order. Opting for a market order allows users to instantly trade at the prevailing market price.

- If the current market price for BNB/USDT is 312.91, but you prefer to purchase at a specific price, such as 310, you can utilize a [Limit] order. Your order will be executed once the market price reaches your designated price point.

- The percentages displayed within the BNB [Amount] field indicate the proportion of your available USDT holdings that you want to allocate for trading BNB. Adjust the slider to modify the desired amount accordingly.

How to Trade Spot on Pionex (App)

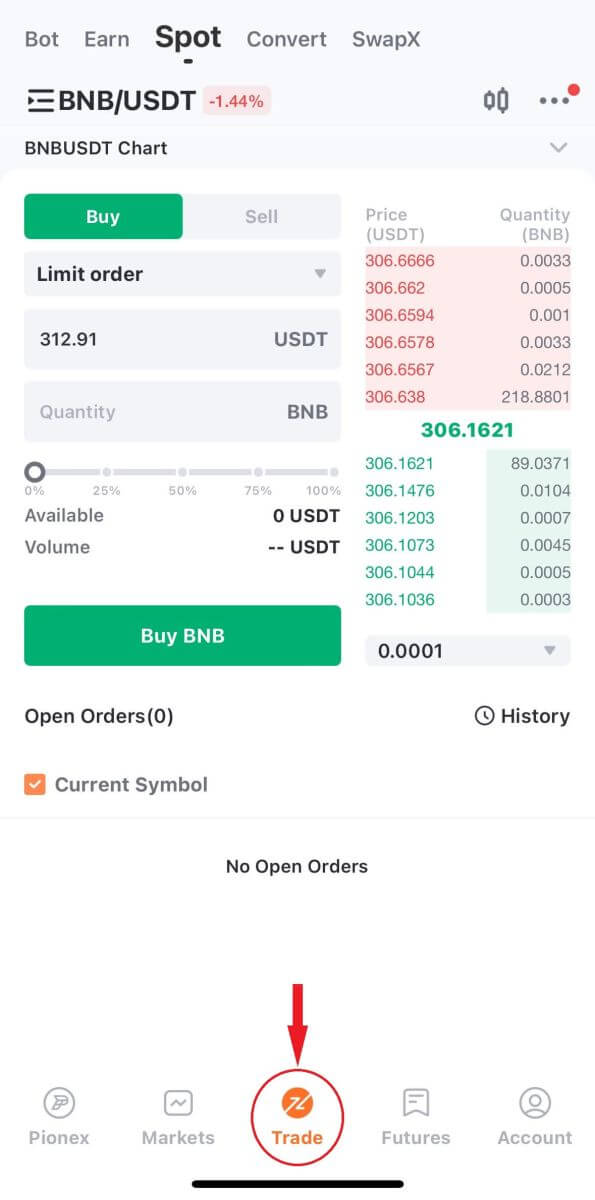

1. Log in to the Pionex App, and click on [Trade] to go to the spot trading page.

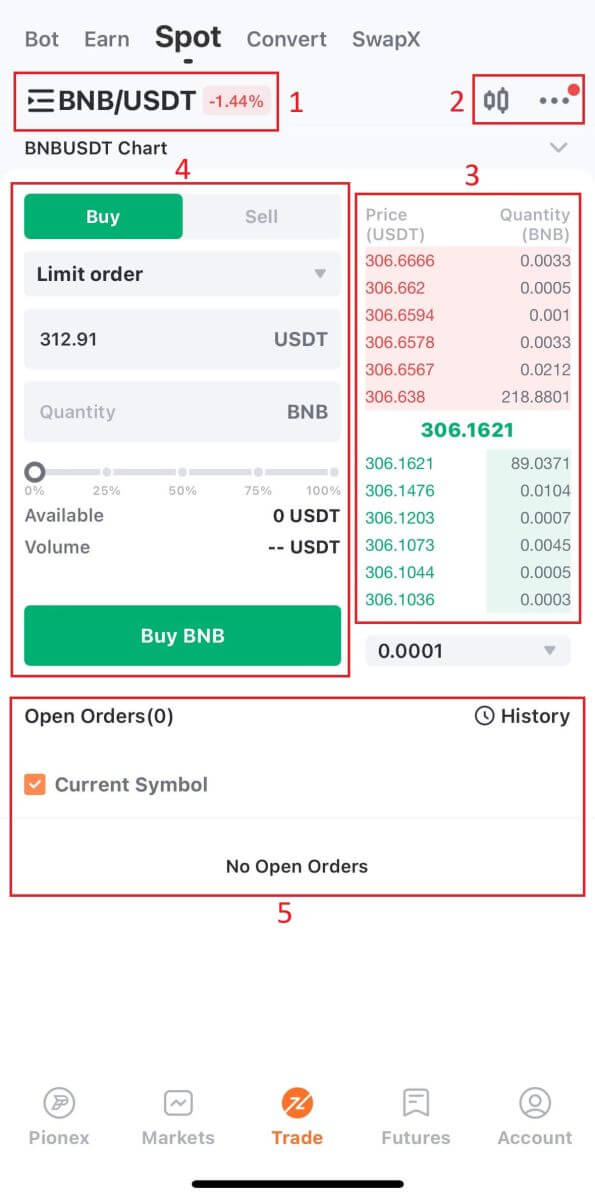

2. Here is the trading page interface.

1. Market and Trading pairs.

2. Real-time market candlestick chart and Tutorial

3. Buy/Sell order book.

4. Buy/Sell Cryptocurrency.

5. Open orders and History

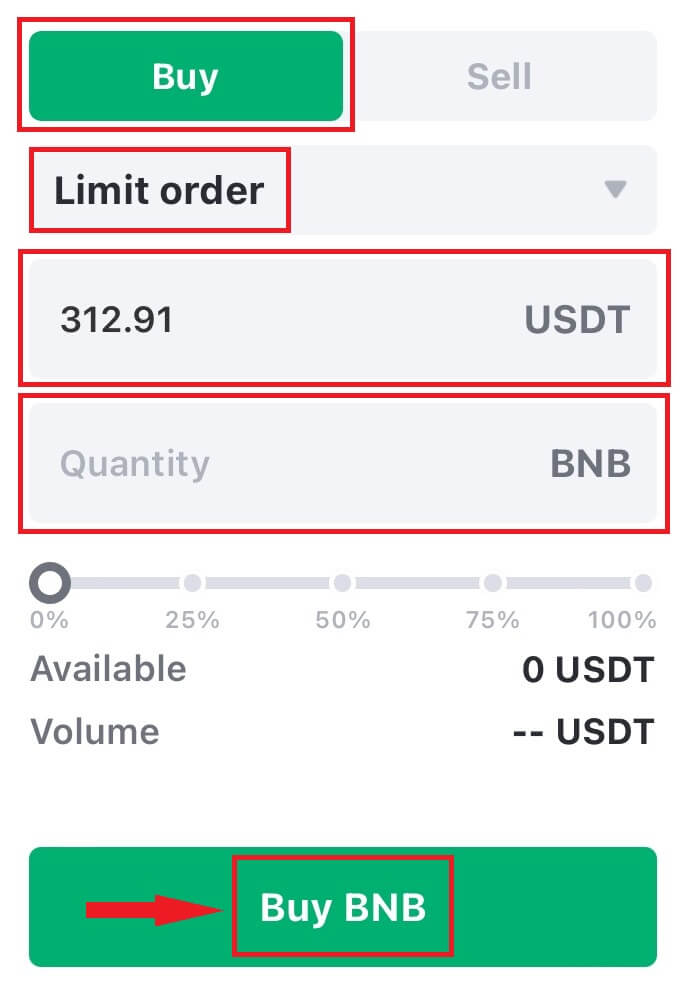

As an example, we will make a "Limit order" trade to buy BNB

(1). Enter the spot price at which you want to purchase your BNB to activate the limit order. We have configured this value at 312.91 USDT per BNB.

(2). Enter the desired amount of BNB you intend to purchase in the [Amount] field. Alternatively, utilize the percentages below to specify the portion of your available USDT you wish to allocate for buying BNB.

(3). Upon reaching a market price of 312.91 USDT for BNB, the limit order will be activated and finalized. Subsequently, 1 BNB will be transferred to your spot wallet.

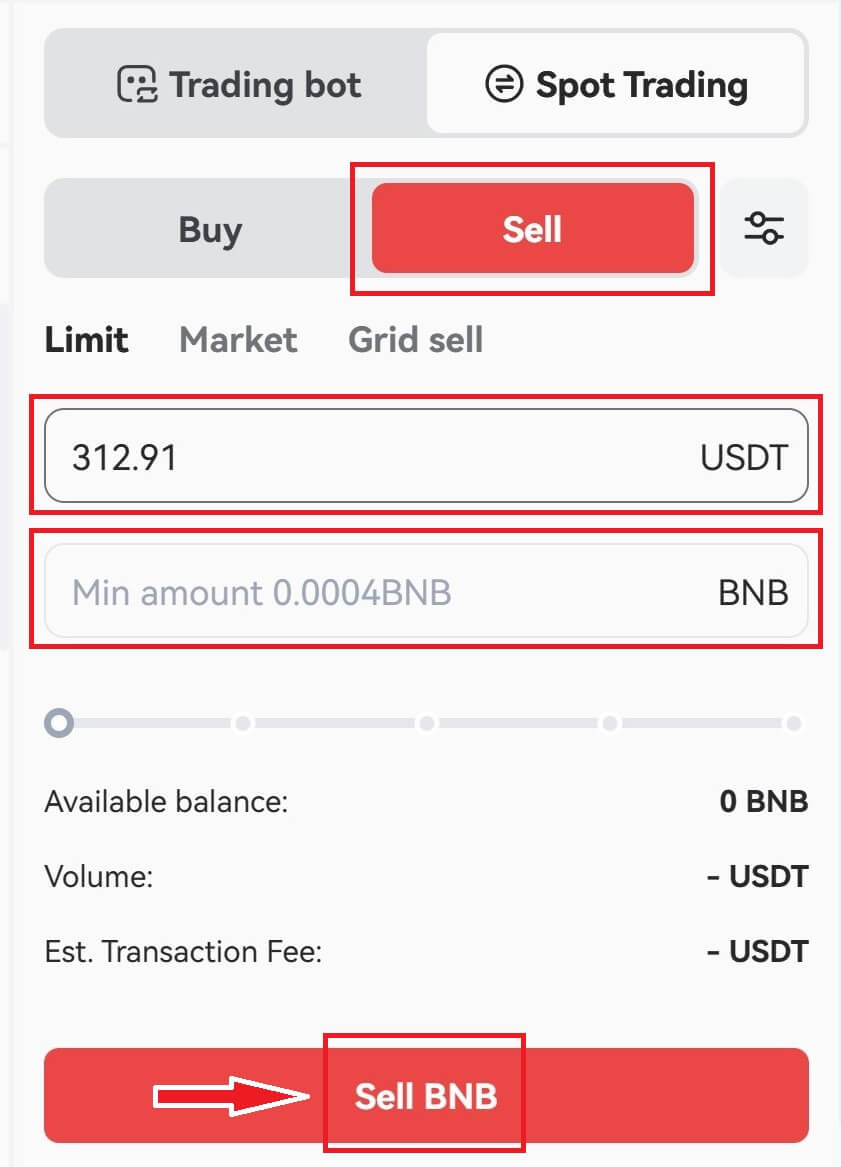

To sell BNB or any other preferred cryptocurrency, simply follow the same steps by choosing the [Sell] tab.

Note:

- The default order type is a limit order. If traders wish to execute an order promptly, they can switch to a [Market] Order. Opting for a market order enables users to trade instantly at the prevailing market price.

- If the market price of BNB/USDT is 312.91, but you desire to purchase at a specific price, such as 310, you can place a [Limit] order. Your order will be executed once the market price reaches the specified amount.

- The percentages displayed below the BNB [Amount] field indicate the percentage of your held USDT that you intend to trade for BNB. Adjust the slider to modify the desired amount.

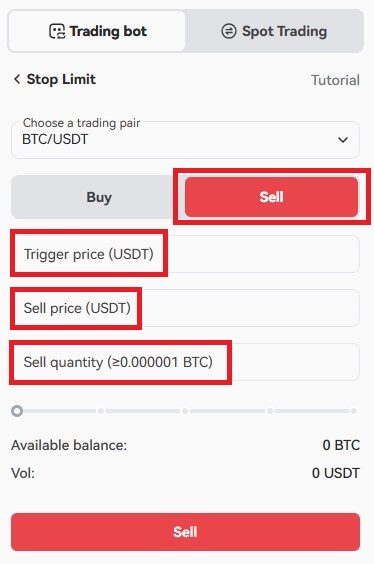

What is the Stop-Limit Function and How to use it

What is a stop-limit order?

The Stop Limit bot allows you to predefine a trigger price, order price, and order quantity. Once the latest price reaches the trigger price, the bot automatically executes the order at the preset order price.For instance, suppose the current BTC price is 2990 USDT, with 3000 USDT being a resistance level. Anticipating a potential price increase beyond this level, you can set up the Stop Limit bot to buy more when the price hits 3000 USDT. This strategy is particularly useful when you cannot monitor the market continuously, providing an automated way to implement your trading ideas.

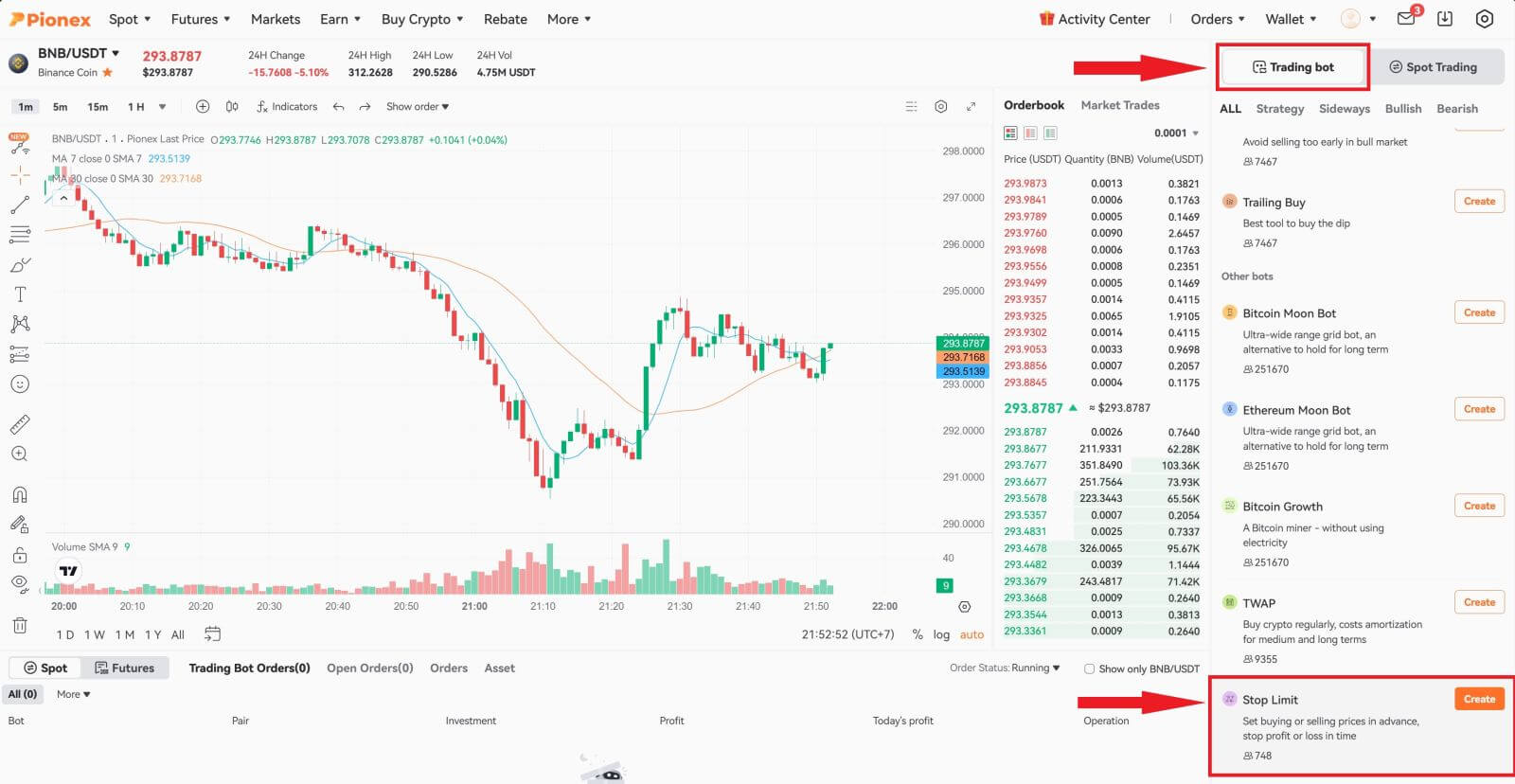

How to create a stop-limit order

Kindly visit pionex.com, log in to your account, click "Trading bot" and proceed to select the "Stop Limit" bot located on the right side of the page.

Once you locate the "Stop Limit" bot, click on the "CREATE" button to access the parameter setting page.

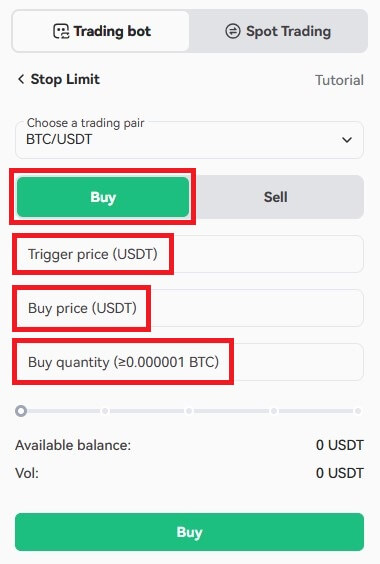

- Trigger Price: Once the "latest price" aligns with the user-set "trigger price", the trigger is activated, and the order is initiated.

- Buy/Sell Price: Following the trigger, the order is executed at the designated commission price.

- Buy/Sell Quantity: Specifies the quantity of orders placed post-trigger.

For example:

“Stop Limit(Sell)” Use Cases

Using BTC/USDT as an example: suppose you’ve purchased 10 BTC at 3000 USDT, with the current price hovering around 2950 USDT, considered as the support level. If the price falls below this support level, there’s a risk of further decline, necessitating a timely implementation of a stop-loss strategy. In such a scenario, you can proactively set an order to sell 10 BTC when the price reaches 2900 USDT to mitigate potential losses.

“Stop Limit(Buy)” Use Cases

Using BTC/USDT as an example: presently, the BTC price stands at 3000 USDT, with an identified resistance level near 3100 USDT according to indicator analysis. Should the price successfully surpass this resistance level, there is a potential for further upward movement. In anticipation of this, you can place an order to purchase 10 BTC when the price reaches 3110 USDT to capitalize on the potential rise.

Frequently Asked Questions (FAQ)

What is a Limit Order

When analyzing a chart, there are instances where you aim to acquire a coin at a specific price. However, you also want to avoid paying more than necessary for that coin. This is where a limit order becomes essential. Various types of limit orders exist, and I will elucidate the distinctions, their functionalities, and how a limit order differs from a market order.When individuals engage in cryptocurrency transactions, they encounter various purchasing options, one of which is the limit order. A limit order involves specifying a particular price that must be reached before the transaction is completed.

For example, if you aim to purchase Bitcoin at $30,000, you can place a limit order for that amount. The purchase will only proceed once the actual price of Bitcoin reaches the designated $30,000 threshold. Essentially, a limit order hinges on the prerequisite of a specific price being attained for the order to be executed.

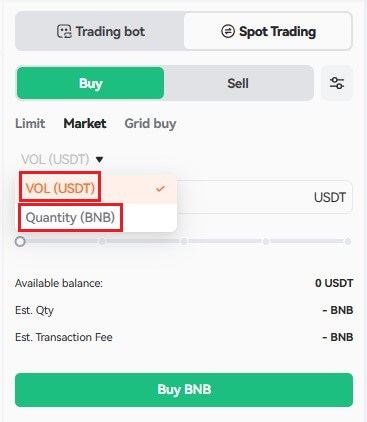

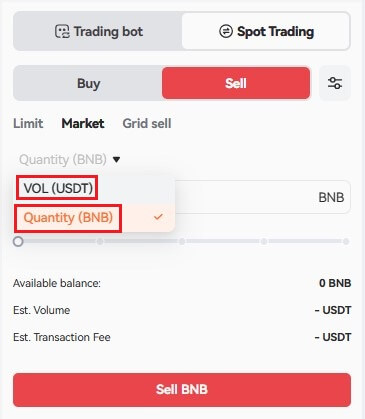

What is Market Order

A market order is promptly executed at the prevailing market price upon placement, facilitating swift execution. This order type is versatile, allowing you to utilize it for both buying and selling transactions.You can select [VOL] or [Quantity] to place a buy or sell market order. For example, if you want to buy a certain quantity of BTC, you can enter the amount directly. But if you want to buy BTC with a certain amount of funds, such as 10,000 USDT, you can use [VOL] to place the buy order.

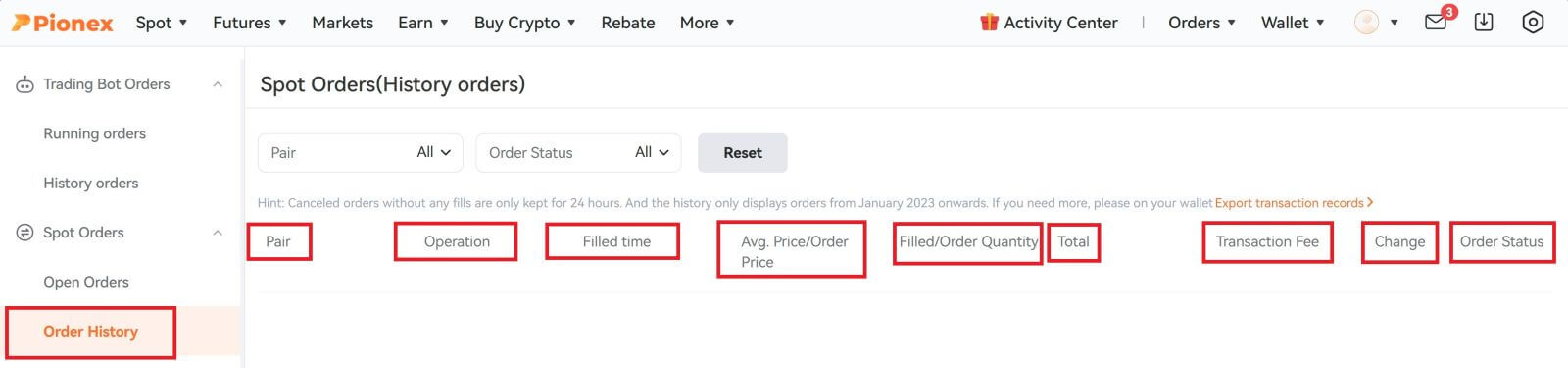

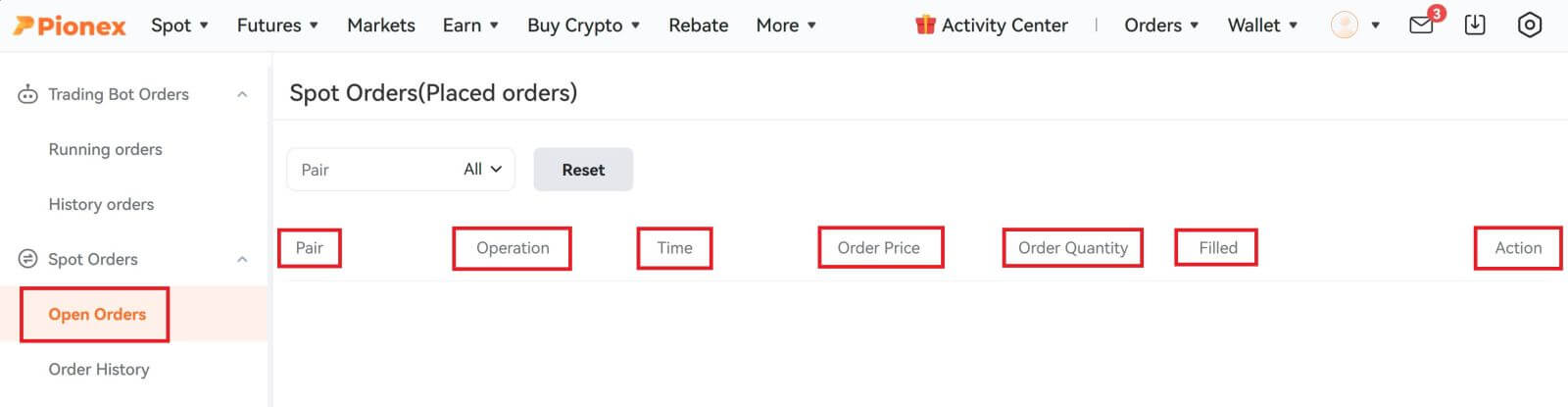

How to View My Spot Trading Activity

You can view your spot trading activities from the Orders and click Spot Orders. Simply switch between the tabs to check your open order status and previously executed orders.1. Open orders

Under the [Open Orders] tab, you can view details of your open orders, including:

- Trading pair

- Order operation

- Order time

- Order Price

- Order Quantity

- Filled

- Action

2. Order history

Order history displays a record of your filled and unfilled orders over a certain period. You can view order details, including:

- Trading pair

- Order operation

- Filled time

- Average Price/Order Price

- Filled/Order Quantity

- Total

- Transaction fee

- Change

- Order Status